Why a US debt deal may only provide short-term relief for markets

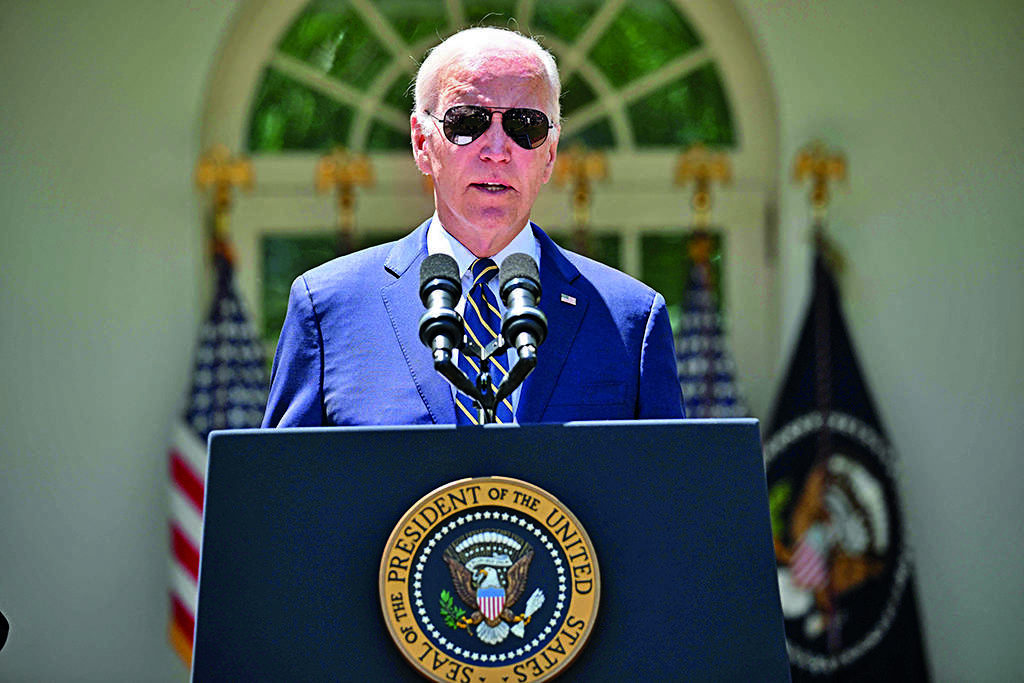

The tentative deal between President Biden and Kevin McCarthy to raise the US debt ceiling may have negative consequences for financial markets. Once the deal has passed, the government is expected to make large bond issuances, which could lead to a liquidity drain from banks and cause financing to become more expensive for companies already struggling in a high-interest rate environment. Some banks fear that markets have not yet accounted for this risk, and some warn that delaying the resolution could cause volatility in the market. However, some believe that the drain on liquidity could be absorbed by money market mutual funds.

The tentative deal between President Biden and Kevin McCarthy to raise the US debt ceiling may have negative consequences for financial markets. Once the deal has passed, the government is expected to make large bond issuances, which could lead to a liquidity drain from banks and cause financing to become more expensive for companies already struggling in a high-interest rate environment. Some banks fear that markets have not yet accounted for this risk, and some warn that delaying the resolution could cause volatility in the market. However, some believe that the drain on liquidity could be absorbed by money market mutual funds.from Stocks-Markets-Economic Times https://ift.tt/PtJ8AMF

Comments

Post a Comment